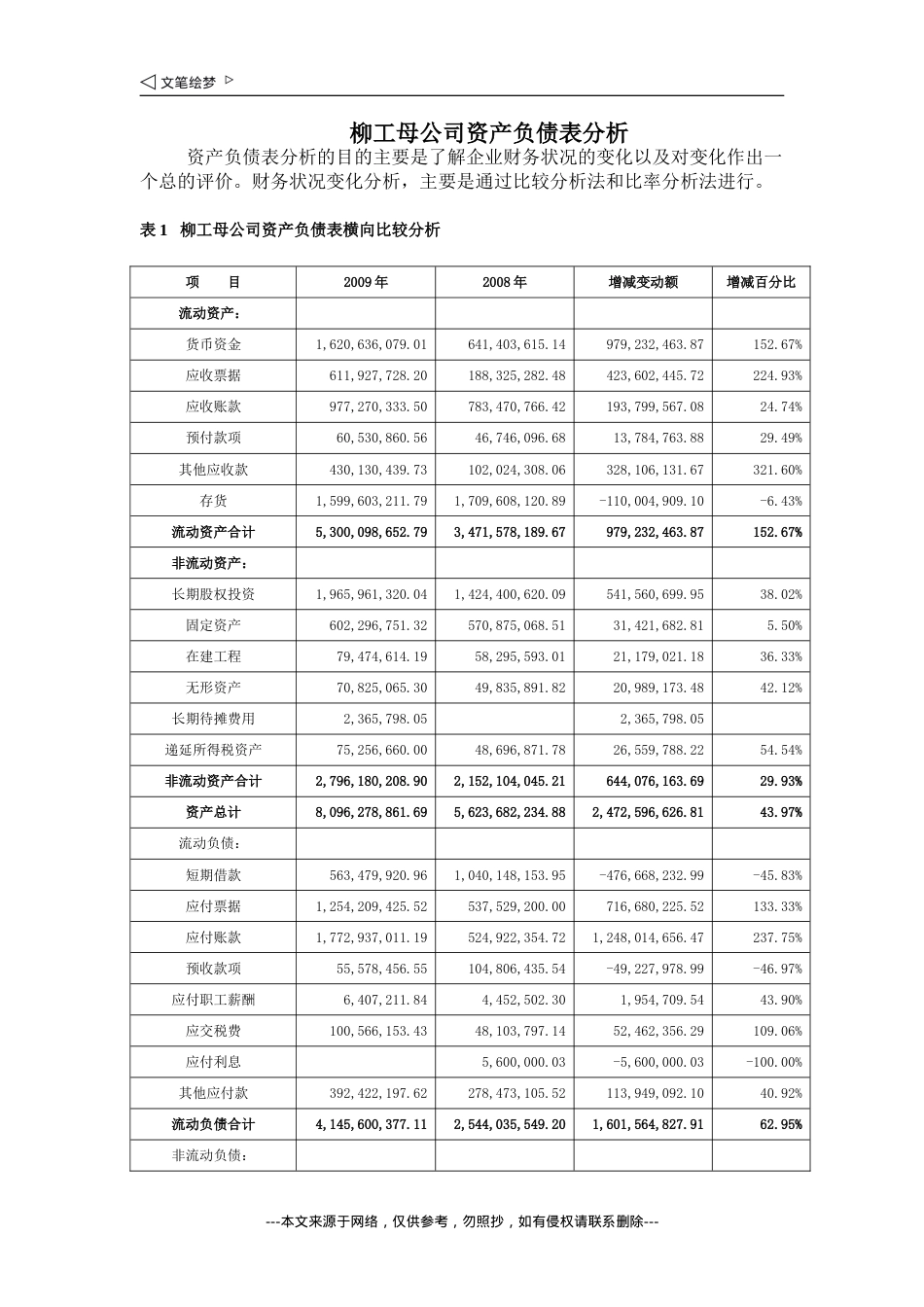

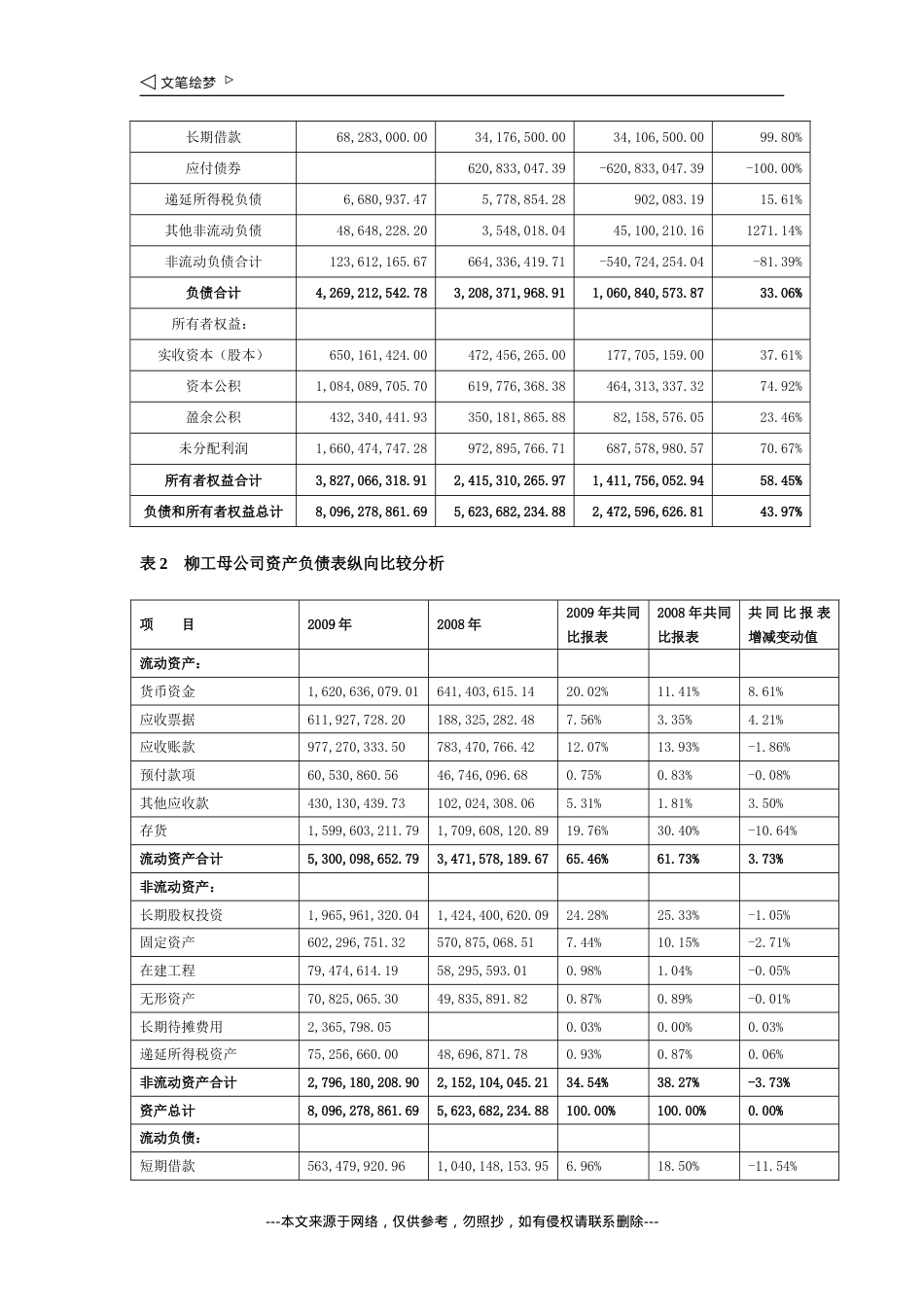

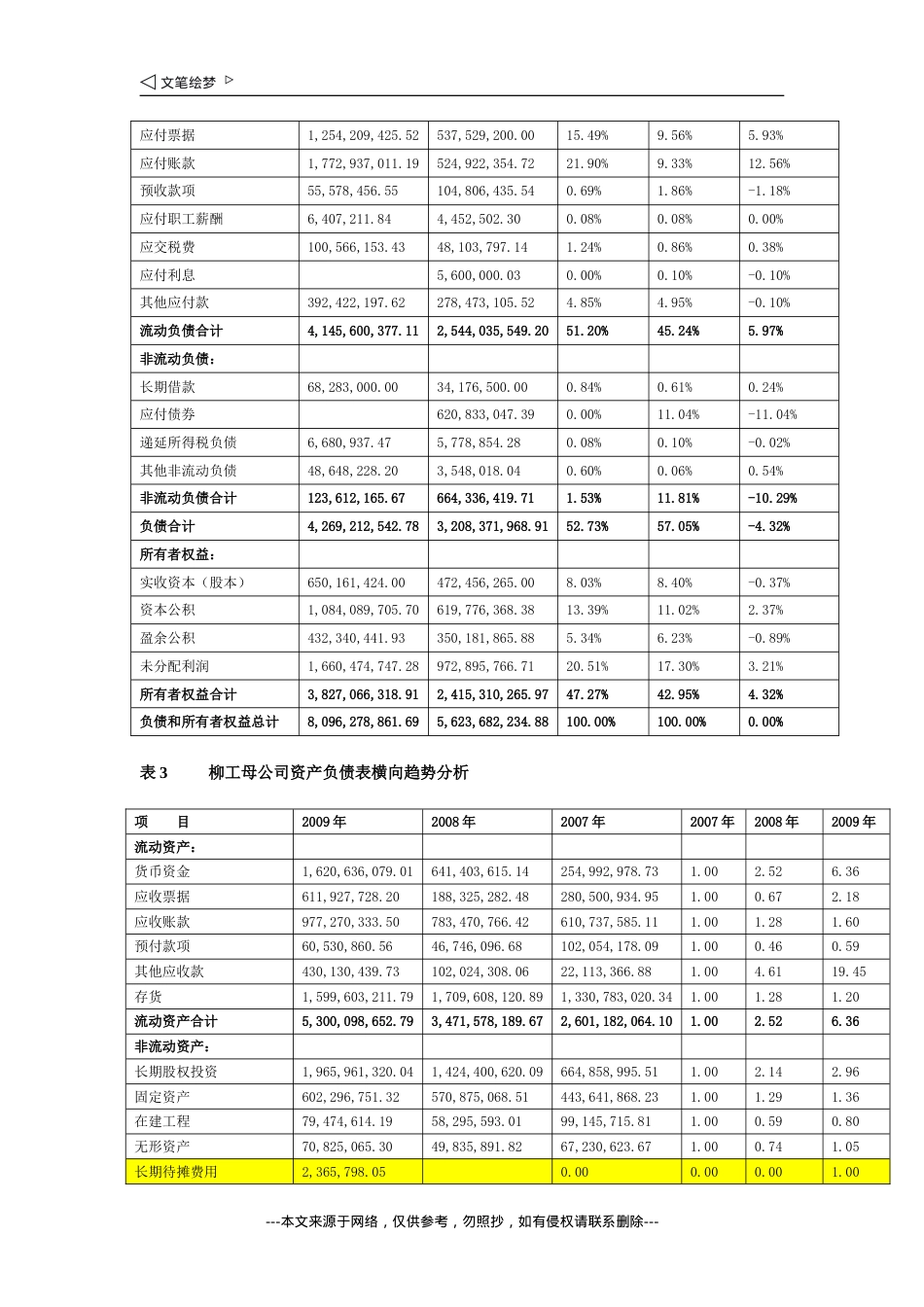

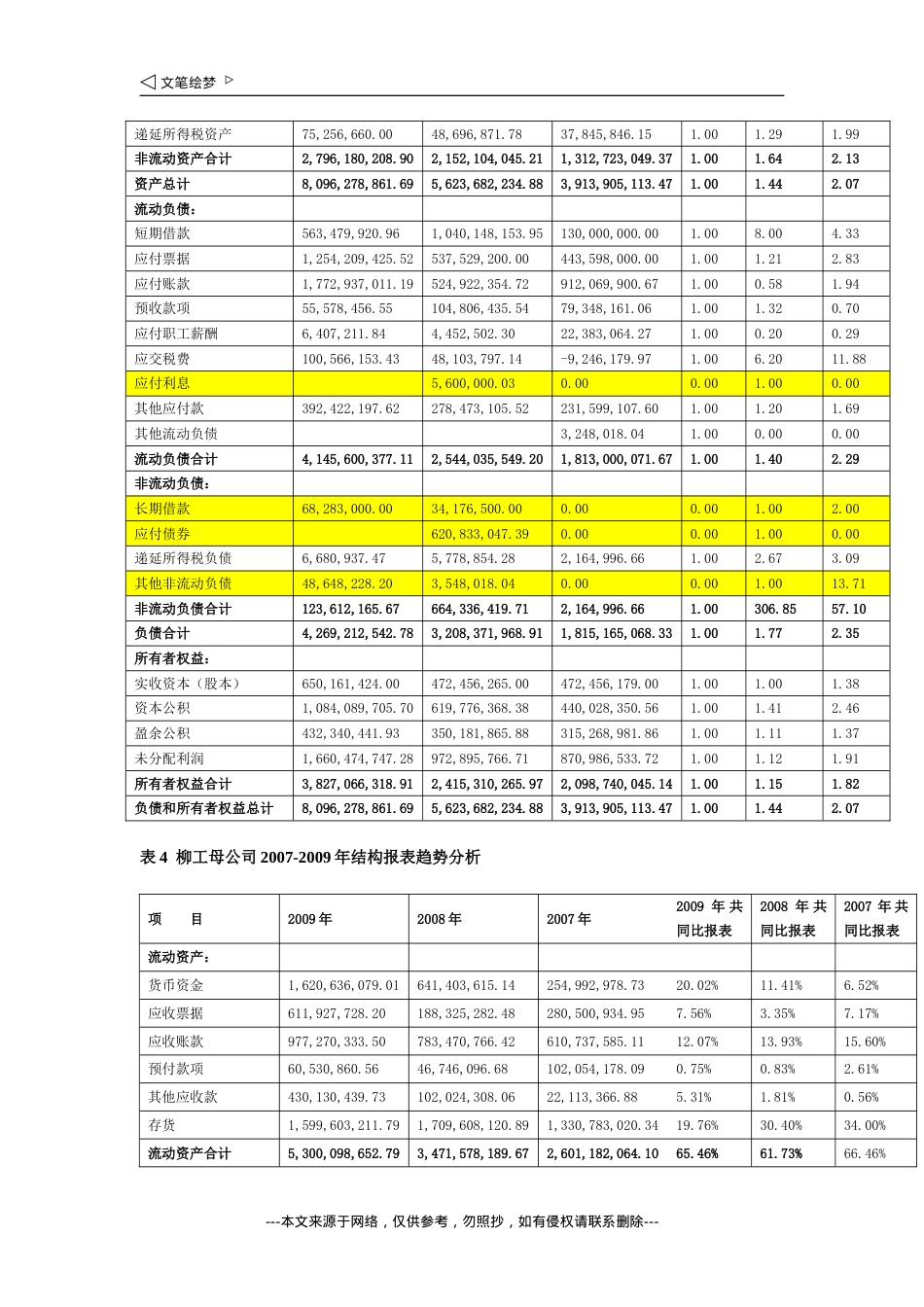

柳工母公司资产负债表分析资产负债表分析的目的主要是了解企业财务状况的变化以及对变化作出一个总的评价。财务状况变化分析,主要是通过比较分析法和比率分析法进行。表1柳工母公司资产负债表横向比较分析项目2009年2008年增减变动额增减百分比流动资产:货币资金1,620,636,079.01641,403,615.14979,232,463.87152.67%应收票据611,927,728.20188,325,282.48423,602,445.72224.93%应收账款977,270,333.50783,470,766.42193,799,567.0824.74%预付款项60,530,860.5646,746,096.6813,784,763.8829.49%其他应收款430,130,439.73102,024,308.06328,106,131.67321.60%存货1,599,603,211.791,709,608,120.89-110,004,909.10-6.43%流动资产合计5,300,098,652.793,471,578,189.67979,232,463.87152.67%非流动资产:长期股权投资1,965,961,320.041,424,400,620.09541,560,699.9538.02%固定资产602,296,751.32570,875,068.5131,421,682.815.50%在建工程79,474,614.1958,295,593.0121,179,021.1836.33%无形资产70,825,065.3049,835,891.8220,989,173.4842.12%长期待摊费用2,365,798.052,365,798.05递延所得税资产75,256,660.0048,696,871.7826,559,788.2254.54%非流动资产合计2,796,180,208.902,152,104,045.21644,076,163.6929.93%资产总计8,096,278,861.695,623,682,234.882,472,596,626.8143.97%流动负债:短期借款563,479,920.961,040,148,153.95-476,668,232.99-45.83%应付票据1,254,209,425.52537,529,200.00716,680,225.52133.33%应付账款1,772,937,011.19524,922,354.721,248,014,656.47237.75%预收款项55,578,456.55104,806,435.54-49,227,978.99-46.97%应付职工薪酬6,407,211.844,452,502.301,954,709.5443.90%应交税费100,566,153.4348,103,797.1452,462,356.29109.06%应付利息5,600,000.03-5,600,000.03-100.00%其他应付款392,422,197.62278,473,105.52113,949,092.1040.92%流动负债合计4,145,600,377.112,544,035,549.201,601,564,827.9162.95%非流动负债:---本文来源于网络,仅供参考,勿照抄,如有侵权请联系删除---长期借款68,283,000.0034,176,500.0034,106,500.0099.80%应付债券620,833,047.39-620,833,047.39-100.00%递延所得税负债6,680,937.475,778,854.28902,083.1915.61%其他非流动负债48,648,228.203,548,018.0445,100,210.161271.14%非流动负债合计123,612,165.67664,336,419.71-540,724,254.04-81.39%负债合计4,269,212,542.783,208,371,968.911,060,840,573.8733.06%所有者权益:实收资本(股本)650,161,424.00472,456,265.00177,705,159.0037.61%资本公积1,084,089,705.70619,776,368.38464,313,337.3274.92%盈余公积432,340,441.93350,181,865.8882,158,576.0523.46%未分配利润1,660,474,747.28972,895,766.71687,578,980.5770.67%所有者权益合计3,827,066,318.912,415,310,265.971,411,756,052.9458.45%负债和所有者权益总计8,096,278,861.695,623,682,234.882,472,596,626.8143.97%表2柳工母公司资产负债表纵向比较分析项目2009年2008年2009年共同比报表2008年共同比报表共同比报表增减变动值流动资产:货币资金1,620,636,079.01641,403,615.1420.02%11.41%8.61%应收票据611,927,728.20188,325,282.487.56%3.35%4.21%应收账款977,270,333.50783,470,766.4212.07%13.93%-1.86%预付款项60,530,860.5646,746,096.680.75%0.83%-0.08%其他应收款430,130,439.73102,024,308.065.31%1.81%3.50%存货1,599,603,211.791,709,608,120.8919.76%30.40%-10.64%流动资产合计5,300,098,652.793,471,578,189.6765.46%61.73%3.73%非流动资产:长期股权投资1,965,961,320.041,424,400,620.0924.28%25.33%-1.05%固定资产602,296,751.32570,875,068.517.44%10.15%-2.71%在建工程79,474,614.1958,295,593.010.98%1.04%-0.05%无形资产70,825,065.3049,835,891.820.87%0.89%-0.01%长期待摊费用2,365,798.050.03%0.00%0.03%递延所得税资产75,256,660.0048,696,871.780.93%0.87%0.06%非流动资产合计2,796,180,208.902,152,104,045.2134.54%38.27%-3.73%资产总计...