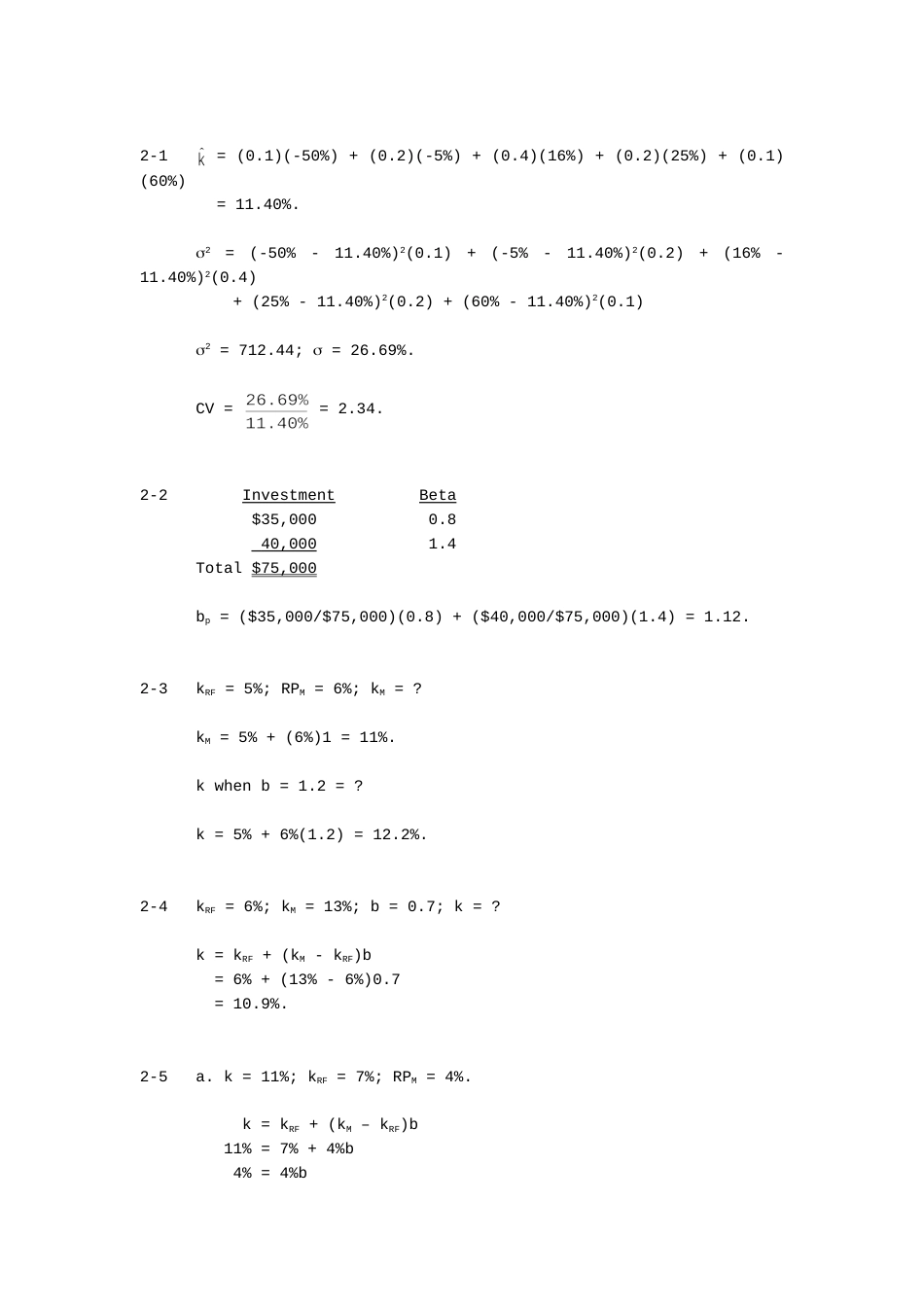

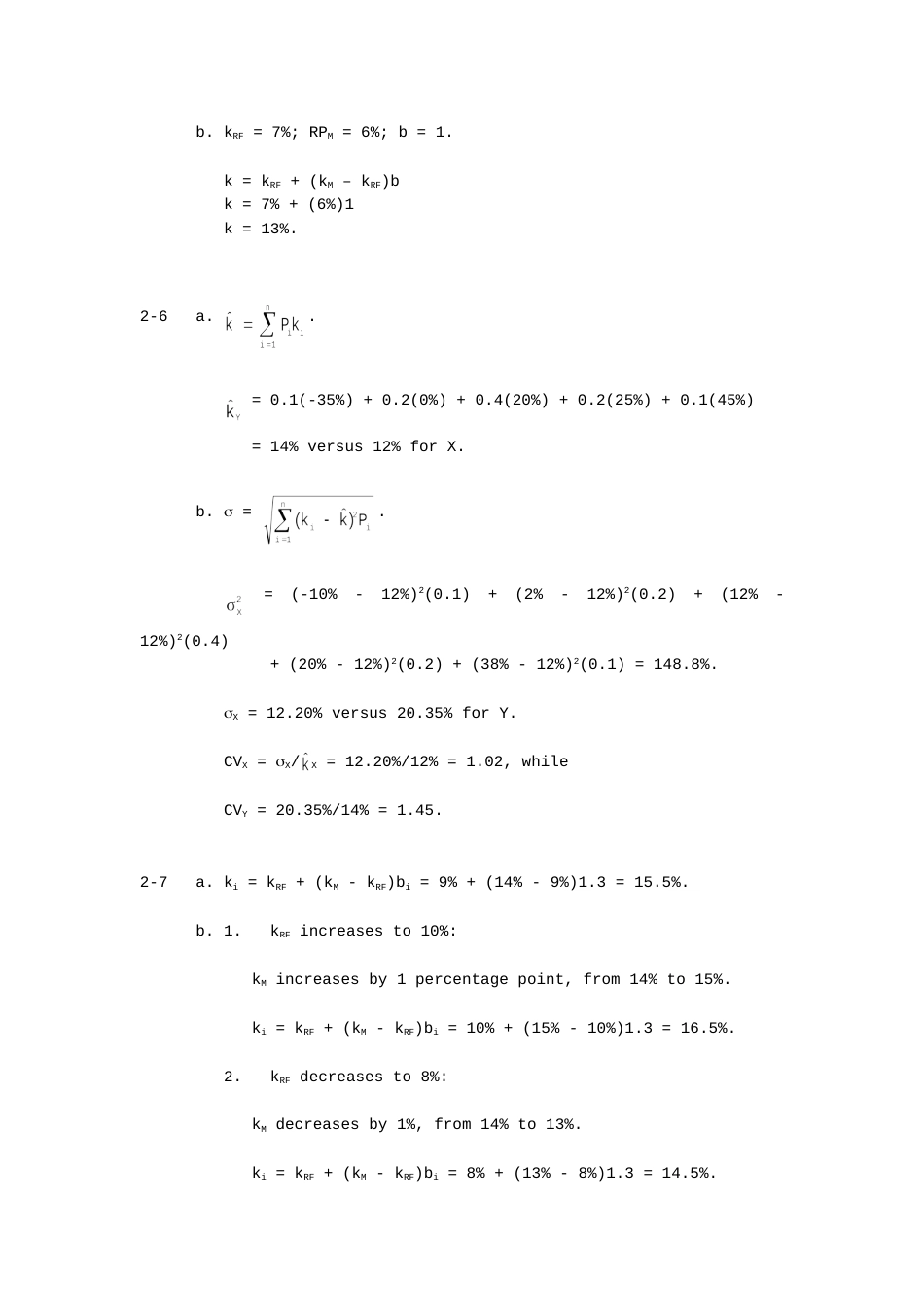

2-1=(0.1)(-50%)+(0.2)(-5%)+(0.4)(16%)+(0.2)(25%)+(0.1)(60%)=11.40%.2=(-50%-11.40%)2(0.1)+(-5%-11.40%)2(0.2)+(16%-11.40%)2(0.4)+(25%-11.40%)2(0.2)+(60%-11.40%)2(0.1)2=712.44;=26.69%.CV==2.34.2-2InvestmentBeta$35,0000.840,0001.4Total$75,000bp=($35,000/$75,000)(0.8)+($40,000/$75,000)(1.4)=1.12.2-3kRF=5%;RPM=6%;kM=?kM=5%+(6%)1=11%.kwhenb=1.2=?k=5%+6%(1.2)=12.2%.2-4kRF=6%;kM=13%;b=0.7;k=?k=kRF+(kM-kRF)b=6%+(13%-6%)0.7=10.9%.2-5a.k=11%;kRF=7%;RPM=4%.k=kRF+(kM–kRF)b11%=7%+4%b4%=4%bb=1.b.kRF=7%;RPM=6%;b=1.k=kRF+(kM–kRF)bk=7%+(6%)1k=13%.2-6a..=0.1(-35%)+0.2(0%)+0.4(20%)+0.2(25%)+0.1(45%)=14%versus12%forX.b.=.=(-10%-12%)2(0.1)+(2%-12%)2(0.2)+(12%-12%)2(0.4)+(20%-12%)2(0.2)+(38%-12%)2(0.1)=148.8%.X=12.20%versus20.35%forY.CVX=X/X=12.20%/12%=1.02,whileCVY=20.35%/14%=1.45.2-7a.ki=kRF+(kM-kRF)bi=9%+(14%-9%)1.3=15.5%.b.1.kRFincreasesto10%:kMincreasesby1percentagepoint,from14%to15%.ki=kRF+(kM-kRF)bi=10%+(15%-10%)1.3=16.5%.2.kRFdecreasesto8%:kMdecreasesby1%,from14%to13%.ki=kRF+(kM-kRF)bi=8%+(13%-8%)1.3=14.5%.c.1.kMincreasesto16%:ki=kRF+(kM-kRF)bi=9%+(16%-9%)1.3=18.1%.2.kMdecreasesto13%:ki=kRF+(kM-kRF)bi=9%+(13%-9%)1.3=14.2%.2-8Oldportfoliobeta=(b)+(1.00)1.12=0.95b+0.051.07=0.95b1.1263=b.Newportfoliobeta=0.95(1.1263)+0.05(1.75)=1.15751.16.AlternativeSolutions:1.Oldportfoliobeta=1.12=(0.05)b1+(0.05)b2+...+(0.05)b201.12=(0.05)=1.12/0.05=22.4.Newportfoliobeta=(22.4-1.0+1.75)(0.05)=1.15751.16.2.excludingthestockwiththebetaequalto1.0is22.4-1.0=21.4,sothebetaoftheportfolioexcludingthisstockisb=21.4/19=1.1263.Thebetaofthenewportfoliois:1.1263(0.95)+1.75(0.05)=1.15751.16.2-9Portfoliobeta=(1.50)+(-0.50)+(1.25)+(0.75)bp=(0.1)(1.5)+(0.15)(-0.50)+(0.25)(1.25)+(0.5)(0.75)=0.15-0.075+0.3125+0.375=0.7625.kp=kRF+(kM-kRF)(bp)=6%+(14%-6%)(0.7625)=12.1%.Alternativesolution:First,calculatethereturnforeachstockusingtheCAPMequation[kRF+(kM-kRF)b],andthencalculatetheweightedaverageofthesereturns.kRF=6%and(kM-kRF)=8%.StockInvestmentBetak=kRF+(kM-kRF)bWeightA$400,0001.5018%0.10B600,000(0.50)20.15C1,000,0001.25160.25D2,000,0000.75120.50Total$4,000,0001.00kp=18%(0.10)+2%(0.15)+16%(0.25)+12%(0.50)=12.1%.2-10WeknowthatbR=1.50,bS=0.75,kM=13%,kRF=7%.ki=kRF+(kM-kRF)bi=7%+(13%-7%)bi.kR=7%+6%(1.50)=16.0%kS=7%+6%(0.75)=11.54.5%2-11=10%;bX=0.9;X=35%.=12.5%;bY=1.2;Y=25%.kRF=6%;RPM=5%.a.CVX=35%/10%=3.5.CVY=25%/12.5%=2.0.b.Fordiversifiedinvestorstherelevantriskismeasuredbybeta.Therefore,thestockwiththehigherbetaismorerisky.StockYhasthehigherbetasoitismoreriskythanStockX.c.kX=6%+5%(0.9)kX=10.5%.kY=6%+5%(1.2)kY=12%.d.kX=10.5%;=10%.kY=12%;=12.5%.StockYwouldbemostattractivetoadiversifiedinvestorsinceitsexpectedreturnof12.5%isgreaterthanitsrequiredreturnof12%.e.bp=($7,500/$10,000)0.9+($2,500/$10,000)1.2=0.6750+0.30=0.9750.kp=6%+5%(0.975)kp=10.875%.f.IfRPMincreasesfrom5%to6%,thestockwiththehighestbetawillhavethelargestincreaseinitsrequiredreturn.Therefore,StockYwillhavethegreatestincrease.Check:kX=6%+6%(0.9)=11.4%.Increase10.5%to11.4%.kY=6%+6%(1.2)=13.2%.Increase12%to13.2%.2-12kRF=k*+IP=2.5%+3.5%=6%.ks=6%+(6.5%)1.7=17.05%.2-13UsingStockX(oranystock):9%=kRF+(kM–kRF)bX9%=5.5%+(kM–kRF)0.8(kM–kRF)=4.375%.2-14Inequilibrium:kJ==12.5%.kJ=kRF+(kM-kRF)b12.5%=4.5%+(10.5%-4.5%)bb=1.33.2-15bHRI=1.8;bLRI=0.6.Nochangesoccur.kRF=6%.Decreasesby1.5%to4.5%.kM=13%.Fallsto10.5%.NowSML:ki=kRF+(kM-kRF)bi.kHRI=4.5%+(10.5%-4.5%)1...